Property Market Review – February 2020

GROWTH IN UK GROCERY SECTOR

Colliers International annual UK Grocery Report has revealed that property investors put £1.78bn into the UK grocery sector in 2019, which is 80% up on volumes in the previous year.

Investment in this sector has jumped due to improvements in financial performance by the UK’s grocery operators and is in sharp contrast to other parts of the retail market which have seen a slump in activity.

Head of Retail Capital Markets for Colliers International, Tom Edson, said: “Investors looking for property assets which offer solid returns underpinned by solid corporate covenants targeted the sector and took buying to levels that haven’t been seen since 2013.”

Elsewhere, the UK’s only listed company dedicated to supermarket property, Supermarket Income REIT, has reported a 1.6% like-for-like growth in its portfolio over the last half of 2019, to take the total property portfolio valuation to £490.4m.

PRIME UK COMMERCIAL PROPERTY RENTS RISE IN 2019

Latest figures from CBRE’s Prime Rent and Yield Monitor show that the industrials sector outperformed the retail and office sectors for the thirteenth consecutive quarter, with industrial prime rents increasing by 1.5% in Q4 2019 and by 5.8% for the year.

Senior Research Analyst at CBRE UK, Pol Marfà Miró, said: “Robust occupational market fundamentals ensured that industrials ended the year strongly. Most investors decided to hold their assets and continue benefiting from high levels of rental growth and healthy pricing.”

Prime rents for the retail sector fell across the board, with a large year-on-year drop of -6.5% in the retail warehouse sector. Rents in the office sector rose by 0.6% in Q4 and 2.6% annually.

MODEST GROWTH EXPECTED OUTSIDE THE RETAIL SECTOR

The latest UK Commercial Property Market Survey from the Royal Institution of Chartered Surveyors (RICS) indicates a modestly stronger outlook emerging for rents and capital values over the year ahead.

However, the downturn in the retail sector shows no signs of easing and according to RICS, a net balance of -58% of respondents saw a fall, rather than a rise, in demand for retail space during the final quarter of 2019.

RICS economist Tarrant Parsons said: “Given the continued rise in retail vacancies and sharply falling demand, any change in fortunes across the sector still seems to be some way off.”

Elsewhere in the survey, prime office rents are anticipated to rise by roughly 2.5% in the coming twelve months, having received an upgrade on the Q3 expectation of 1% growth. Across the industrial sector, rents are forecast to rise by nearly 4% in prime locations (revised from around 2.5% in Q3).

| “Investors looking for property assets which offer solid returns underpinned by solid corporate covenants targeted the sector and took buying to levels that haven’t been seen since 2013.” |

House Prices Headline statistics

| HOUSE PRICE INDEX (DEC 2019)* | 123.0* |

| Average House Price | £234,742 |

| Monthly Change | 0.3% |

| Annual Change | 2.2% |

*(Jan 2015 = 100)

- Average house prices in the UK increased by 2.2% in the year to December 2019, up from 1.7% in November 2019

- House price growth was strongest in Northern Ireland where prices increased by 2.5% over the year

- The lowest annual growth was in the South East, with prices increasing by 1.2% over the year to December 2019

House Prices Price change by region

| Region | Monthly Change (%) | Annual Change (%) | Average Price (£) | |

|---|---|---|---|---|

| England | 0.6 | 2.2 | £251,711 | |

| Northern Ireland (Quarter 4 – 2019) |

<!– |

0.2 | 2.5 | £140,190 |

| Scotland | <!– |

-1.5 | 2.2 | £151,603 |

| Wales | -2.0 | 2.2 | £165,735 | |

| East Midlands | 0.5 | 2.8 | £197,048 | |

| East of England | 2.1 | 2.4 | £297,714 | |

| London | 1.6 | 2.3 | £483,922 | |

| North East | <!– |

0.5 | 1.8 | £130,977 |

| North West | -0.6 | 2.0 | £166,003 | |

| South East | -0.3 | 1.2 | £325,050 | |

| South West | 1.3 | 2.2 | £262,286 | |

| West Midlands Region | -0.4 | 1.4 | £201,343 | |

| Yorkshire & The Humber | <!– |

1.7 | 3.9 | £168,382 |

Source: The Land Registry

Release date: 19/02/2020 Next date release: 25/03/2020

AVERAGE MONTHLY PRICE BY PROPERTY TYPE – DEC 2019

| PROPERTY TYPE | ANNUAL INCREASE |

|---|---|

| DETACHED £359,542 |

3.4% |

| SEMI-DETACHED £223,053 |

2.4% |

| TERRACED £189,326 |

2.1% |

| FLAT / MAISONETTE £206,083 |

0.4% |

Source: The Land Registry

Release date: 19/02/2020

| Contains HM Land Registry data © Crown copyright and database right 2017. This data is licensed under the Open Government Licence v3.0. |

Mortgage Activity

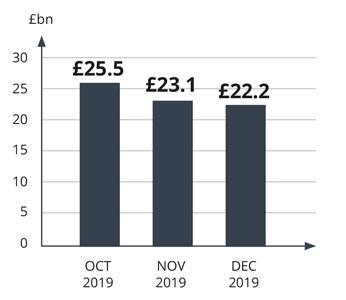

- Gross mortgage lending across the residential market in December 2019 was 22.2 billion

- The total annual residential mortgage lending for 2019 was £265.8 billion

- An annual total of 982,286 residential mortgages were approved by the main high street banks in 2019

Source: UK Finance

Release date: 27/01/2020

@media only screen and (max-width: 768px) {

.single-post__content .mobile-hide {width: 100%!important; margin: 0 0 20px 0!important; display: block!important;}

}

.back-to-top {margin: 20px 0 40px 0; background-color: #eaeaea; color: #666; display: inline-block; padding: 10px; text-decoration: none; border-radius: 3px; border: solid 1px #aaa;}

.back-to-top:hover {margin: 20px 0 40px 0; background-color: #999; color: #fff;}